Mn Gambling License

Exempt/Excluded Permit for Fundraising Events

Class III gambling is conducted under a compact that each tribe negotiates with the government of the state in which it is located. Minnesota tribes were the first in the nation to negotiate and sign gaming compacts with a state government. Both the tribes and the state agreed to limit casinos to video games of chance (slots) and blackjack. Charitable Gambling in Minnesota Page 4. License and Permits. Charitable gambling may only be conducted by a licensed nonprofit organization. A fraternal, veterans, religious, or other nonprofit organization may apply for licensing if it has been in existence for at least three years and has at least 15 active members. Gambling licenses. The Gaming/Gambling License Application Procedure. Once you determine which types of gaming licenses you need to start your business, have your staff fill out applications for themselves. You can determine whether you will pay for the license, or if you will require the employee to pay for it. Fees will vary from $10 to a few hundred dollars. The Alcohol and Gambling Enforcement Division of the Department of Public Safety licenses and regulates liquor sales made by distributors. For more information, visit the Alcohol and Gambling Enforcement website.

COVID-19 Update for Exempt Activities (3/17/20)

- If holding raffle drawing as originally scheduled, you must still follow all lawful raffle conduct requirements plus any health advisory requirements.

- If delaying drawing date or moving drawing location, please email your Licensing Specialist with your permit number, location, and original date of your postponed activity. Publicize the delay of the raffle so people who may have purchased raffle tickets understand the reason for the delay. Your organization will have up to one year from the original date of the permit to reschedule your postponed activity date. Once the information is complete on when and where your event will take place, send the new information with an appropriate signature from the local unit of government acknowledging the activity, and signed by your CEO, to your Licensing Specialist. A new permit will be reissued to your organization with the updated information.

- If you intend to cancel a raffle, your organization will need to return any money received from sales of raffle tickets.

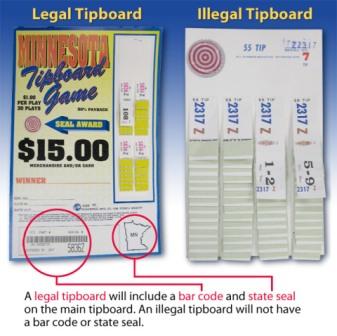

If you have purchased any other gambling equipment such as pull-tabs, tipboards, or paddlewheels and paddletickets, make sure that this equipment is properly secured with invoices until such time as it will be used. You may also be able to return unused equipment to the licensed distributor your organization purchased the equipment from.

Please direct any questions to your Licensing Specialist via email. This will ensure a quicker response than a telephone call at this time.

END OF UPDATE

_____________________________________________________________________________________________________________________

The following information pertains to registered nonprofit organizations seeking to conduct bingo, raffles, and other forms of lawful gambling by excluded or exempt permit as allowed by Minnesota law.

You will need to determine for the calendar year:

- what type of gambling you will be conducting,

- how many events will be conducted (for raffles, the event date is the drawing date), and

- the estimated total market value of all donated and purchased prizes to be awarded.

An organization may not conduct both exempt and excluded activity in the same calendar year.

Forms and information for the conduct of raffles, bingo, pull-tabs, tipboards, and paddlewheels.

Scholarship applications now open through October 31, 2019

To become a DHS-approved problem gambling provider in Minnesota an individual must: 1) be a licensed alcohol and drug counselor, mental health professional (licensed clinical social worker, psychologist, marriage or family therapist) or a psychiatric registered nurse, and 2) complete additional gambling training approved by the Minnesota Department of Human Services (DHS).

A counselor can become certified by taking training available online through the University of Minnesota Duluth/North American Training Institute.

Professionals may earn an International Certified Gambling Counselor (ICGC) credential offered through the International Gambling Counselor Certification Board. More information can be found here. If counselors have previously received training through another state’s program and hold an ICGC, reciprocity may be available.

Prospective gambling counselors interested in accessing Minnesota problem gambling funds must be in a contractual relationship with DHS prior to beginning any training or counseling. No treatment or scholarship reimbursements are available prior to DHS approval.

DHS provides a timeline for those seeking to become qualified gambling treatment providers as well as an application.

Scholarship Available

The Minnesota DHS offers a scholarship to assist counselors in completing the Studies in Gambling Addiction certificate offered through the University of Minnesota Duluth/North American Training Institute.

To apply for a scholarship, please contact DHS Problem Gambling Program staff. Scholarship applications are only available when there is an open RFP and after training approval is received.

Scholarship applications are available for a limited, designated time as determined by DHS. If you are interested, please complete the application and return to Trevor Urman at DHS. Do not enroll in the training until you’ve received DHS approval.

A limited number of full scholarships are available to providers working with an identified underserved population. Note: Professionals can be gambling counselors in Minnesota without DHS oversight. DHS approves/certifies providers/counselors only if they desire to access state grant funds for this use.

If you’re interested in learning more about becoming a certified gambling counselor in Minnesota or have questions, please call DHS Problem Gambling Program staff: Trevor Urman, (651) 431-2231.